You can trust VideoGamer. Our team of gaming experts spend hours testing and reviewing the latest games, to ensure you're reading the most comprehensive guide possible. Rest assured, all imagery and advice is unique and original. Check out how we test and review games here

We’re halfway through the financial year and, alongside a presentation from Nintendo’s President Shuntaro Furukawa, we now have access to Nintendo’s financial numbers following the Nintendo Switch 2 launch. Alongside just sales numbers, it includes adjustments to their forecast for how well Nintendo expects the period up until April next year to perform.

These numbers are really just for investors to see how much money they’re getting out, or how much more they should put in, but they’re also great indicators of how everything looks to be panning out for Nintendo’s future. It would be ridiculous to expect every fan to pore through these numbers, so we’ve got an ex-accountant-now-journalist to divine the meaning behind these arcane numerical sigils.

- Nintendo has released sales figures following the Nintendo Switch 2 launch, as well as forecasts for the future.

- The Nintendo Switch 2’s sales are strong, but the price is responsible for a lowered profit ratio.

- Mario Kart World is the top-selling Nintendo Switch 2 game, but the Nintendo store is still selling more original Switch games.

- Nintendo wants to sell Mario as a brand as much as a game, with a big IP push.

- Your Switch Account is more valuable to Nintendo than ever as the digital sales landscape pushes profits.

Nintendo Switch 2 sales are strong, but profit is down

We already knew the Nintendo Switch 2’s sales were strong, but they’re higher than even Nintendo anticipated. Its forecast has been increased, with Nintendo Switch 2’s expected sales up by 25% for the financial year, all the way up to 19 million units sold. This could explain the Switch 2 shortages at launch. The console is the company’s fastest-selling ever. With this foundation, Nintendo wants to “shift [its] primary development focus to Nintendo Switch 2”.

84% of the console sales were to original Nintendo Switch owners, and while a migration of Nintendo fans is expected, that means over the last six months, 1.6 million users bought a Nintendo console for the first time in eight years. The complete backwards compatibility of the Nintendo Switch 2 probably helps new user adoption, and this aligns with Furukawa’s desire to “foster long-term relationships with consumers”.

The cost of a new hardware launch has cut into Nintendo’s profit margins, as its gross profit has gone up year-on-year by 25%, but its gross profit ratio has declined by just as much, meaning its costs are up as much as its gains. This is partially because the Nintendo Switch 2 generates less profit per console than the Nintendo Switch, which may explain the unpopular increase in Mario Kart World’s cost, with a price set to soften the blow of a new hardware launch.

The Nintendo Switch 2 is being propped up by Switch games

It’s no surprise that Mario Kart World was the best-selling game for Nintendo for the first half of the financial year. 92% of Switch 2 owners have picked up the new kart racer. It makes up around 46% of all the games sold on the Nintendo Switch 2. This isn’t all raw sales, as 39% of all Switch 2 games sold were bundled with the hardware in an attempt to make the high entry cost more palatable.

There were almost three times as many Nintendo Switch software sold in this period as on the new console, so it’s clear that there needs to be more reasons for players to pick up the Nintendo Switch 2. Mario Kart World and Donkey Kong Bananza might have sold well, but the third most successful game of the period was Mario Kart 8 Deluxe. With Mario Kart World only selling 7 times as many copies as an eight-year-old game, it’s clear that the launch title could have done better.

Sales will be boosted by the already popular Pokémon Z-A, which has already sold more than Donkey Kong Bananza, and big hitters like Metroid Prime 4 Beyond. However, these titles are still launching on both generations of Nintendo consoles. These dual-generation releases will start to dry up, but half of Pokémon Z-A’s sales were on the original Nintendo Switch. Pokémon is a guaranteed success, but it’s also a stark reminder that a large amount of Nintendo’s market lies with younger players, and Donkey Kong just doesn’t have the same appeal.

Nintendo wants to sell you its IPs now more than ever

Nintendo isn’t just in the business of games anymore, and Furukawa lists “grow the Nintendo IP fanbase” as the first of two principles for Nintendo’s business. Furukawa added that “by working to help foster an enduring fondness for Nintendo IP, we hope to become a beloved part of people’s lives across generations.”

This attitude threatens to divert Nintendo’s attention from the gaming space as it focuses on entering people’s homes in other ways, building brands rather than just making games. It makes good business sense, as The Super Mario Bros Movie has made almost as much as all of Nintendo’s digital sales for the last six months, but we’ve also not seen a new headline Mario game since Super Mario Odyssey. With ‘once-a-generation’ being the norm, Nintendo wants to flaunt its mascot in other ways.

With 950 million unique downloads for apps published by Nintendo, including games like Mario Kart Tour, which peddle microtransactions to their young fanbase, we can only expect Nintendo to split its focus more. This could be part of the increase in ‘research and development’ expenses, going up 20% year-on-year, as Nintendo moves from making games to making a profitable brand.

The ratio might be down, but digital is the future for Nintendo

The proportion of Nintendo’s digital sales has dropped to 54.5%, indicating that physical sales still hold a significant place in Nintendo’s earnings, especially with people purchasing the new console. Their digital-only stock remains strong, with half of their digital sales comprising download-only software or Nintendo Switch Online subscriptions.

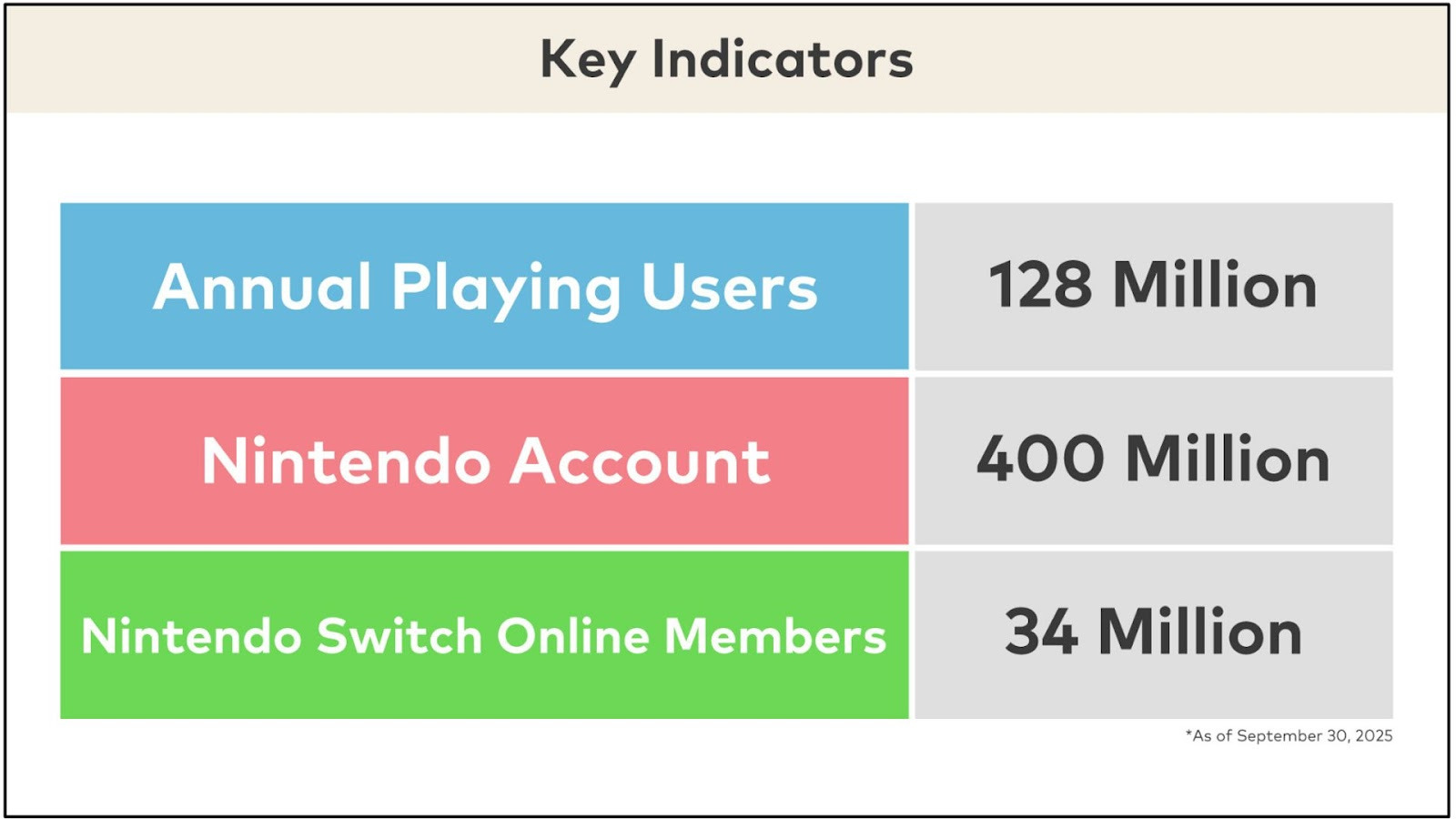

With 34 million Nintendo Switch Online Members, Nintendo has a consistent user base connecting to its services with lower development costs. We’ve also seen more paid add-on offerings, such as for Donkey Kong Bananza, and we should expect Nintendo to continue this push. With a loyal fan base, smaller packages are a prime way to boost digital sales and increase the profit ratio.

Nintendo’s focus for the coming year is clear: strengthening the Nintendo brand. It wants you to sign up for an account, get online, and surround yourself with their IP. The push for hardware is just one side of things. The future might be as bright as they forecast, but we risk seeing Nintendo ceasing to be a monolith of gaming excellence.

FAQs

Nintendo’s financial results for the first half of FY26 are largely positive, with strong 10 million unit sales for the Nintendo Switch 2 and nearly double their sales year-on-year. However, profit margin is actually down due to the comparatively high cost-of-goods of the Nintendo Switch 2.

The Nintendo Switch is just at the end of its lifecycle, so there’s as much value as you’re going to get. The Nintendo Switch 2 is a bit more of a gamble, but with Nintendo being the last major holdout on exclusives, if you think you’ll want any Mario games going forward, then it’s a sure bet.

Quite the opposite, the Nintendo Switch 2 is the fastest-selling Nintendo console of all time; however, it will need a stronger software offering to attract more consumers.

So far, only Mario Kart World is $80 (£67). This has been for several cited reasons, including increased development costs that counteract the profit margins offered by digital distribution. With Nintendo’s recent numbers, this price rise could also be necessary to maintain their profit ratio, counteracting the loss from the Nintendo Switch 2.